Key Advantages of Offshore Company Formation for Property Defense and Tax Obligation Performance

Offshore business development provides a tactical opportunity for people and services looking for improved property defense and tax effectiveness. By developing an offshore entity, one can effectively secure possessions from potential lawful cases and creditors, while also taking benefit of favorable tax obligation regimes that provide reduced or no corporate tax rates.

Boosted Asset Security

Among the key advantages of overseas business formation is enhanced asset protection. By establishing an offshore entity, people and companies can protect their possessions from possible legal cases, financial institutions, and political instability in their home nations (offshore company formation). Offshore jurisdictions typically give robust lawful frameworks that focus on the discretion and personal privacy of possession owners, making it extra challenging for exterior celebrations to accessibility or take these properties

Additionally, numerous overseas territories supply minimal obligation defenses, which implies that the personal possessions of the investors or directors are generally secured from the debts and responsibilities sustained by the firm. This separation of individual and organization properties is critical for business owners and capitalists who wish to minimize their exposure to run the risk of.

Moreover, overseas business can make use of numerous lawful frameworks, such as trusts and structures, which additionally improve asset defense by creating layers of security versus potential claims. These entities can successfully set apart properties, making it challenging for financial institutions to permeate. Eventually, the tactical development of an offshore business functions as a positive measure to protect wide range, guaranteeing that properties continue to be safe and obtainable to their rightful owners.

Tax Optimization Opportunities

Developing an offshore business not just boosts property protection however likewise unlocks to substantial tax optimization chances. Among the main advantages of overseas company formation is the ability to leverage beneficial tax regimens available in numerous jurisdictions. Many countries provide reduced or no corporate tax obligation prices, which can dramatically lower the general tax burden for services.

Additionally, offshore companies typically profit from tax treaties that can reduce withholding tax obligations on dividends, rate of interest, and aristocracies. This calculated positioning enables reliable repatriation of revenues, making best use of returns for shareholders. The usage of overseas entities can promote tax deferment, allowing companies to reinvest incomes without instant tax obligation implications.

Another key element is the capacity for revenue splitting among relative or associated entities, successfully decreasing the overall tax obligation rate. By distributing income to recipients in reduced tax obligation brackets, organizations can enhance their tax responsibilities.

Additionally, overseas firms can provide opportunities for resources gains tax exceptions, especially in jurisdictions that do not levy taxes on particular financial investments. This combination of aspects placements offshore firms as an effective device for effective tax obligation preparation, making it possible for company owner to maintain even more riches and improve financial growth.

Privacy and Privacy

The personal privacy and discretion provided by overseas firms are essential advantages that interest many entrepreneur. In a progressively interconnected globe, maintaining discernment in service operations is essential for visit homepage safeguarding delicate info and mitigating dangers connected with possible lawful conflicts or regulatory scrutiny. Offshore territories usually give robust legal structures that focus on the safeguarding of personal and business information, allowing proprietors to conduct their affairs with a higher degree of anonymity.

Numerous overseas territories do not need the public disclosure of investor or director details, which implies that the identities of company proprietors can continue to be confidential. This feature not just protects people from undesirable focus but also shields possessions from potential financial institutions or litigants. Furthermore, offshore companies can utilize nominee solutions, where third-party representatives act upon part of the real proprietors, additionally improving privacy.

In enhancement to private privacy, the confidentiality of company purchases is frequently supported, enabling the protected administration of financial details. This level of privacy can be specifically useful for those looking for to secure copyright, trade secrets, or exclusive company methods from competitors and the general public eye. Ultimately, the focus on privacy and privacy makes offshore business formation an appealing alternative for discerning organization owners.

Organization Versatility and Control

Regularly, overseas business give a level of service flexibility and control that is tough to achieve in onshore environments. By enabling business owners to tailor their corporate structure to fulfill particular service demands, offshore jurisdictions help with an even more dynamic functional structure. This versatility can show up in numerous methods, such as choosing the kind of company entity that ideal suits business version, whether it be a restricted obligation company, a depend on, or a worldwide business company (IBC)

In addition, offshore companies usually delight in less rigorous regulatory requirements, making it possible for faster decision-making and minimized bureaucratic hold-ups. This regulatory kindness allows company owner to react promptly to market adjustments and chances without being impeded by extreme conformity obligations. The capacity to operate with diverse money and financial options enhances economic control, further empowering company proprietors to maximize their operational strategies.

The possession frameworks in overseas companies can likewise be personalized, permitting for the visit of supervisors, investors, and useful proprietors according to specific preferences (offshore company formation). This level of control not only enhances business efficiency but also aids in securing individual assets versus unanticipated obligations, therefore adding to total business durability

Accessibility to International Markets

While browsing the complexities of international profession, offshore firms benefit dramatically from their access to international markets. This critical advantage boosts their capacity to take part in cross-border transactions, faucet right into diverse customer bases, and take advantage of affordable rates designs. By establishing an overseas entity, businesses can run in jurisdictions with positive trade agreements, permitting smoother import and export processes.

Moreover, offshore business frequently take pleasure in reduced regulatory concerns and streamlined procedures, enabling them to respond swiftly to market demands. read review This agility is essential in today's busy global economic situation, where versatility can identify success. Accessibility to global markets likewise opens opportunities for partnerships and partnerships with worldwide companies, promoting innovation and growth.

Furthermore, overseas jurisdictions often offer durable banking and monetary services customized to help with international business procedures. offshore company formation. These services can consist of multi-currency accounts and foreign exchange alternatives, which even more bolster the firm's capability to navigate various markets

Final Thought

In summary, overseas anchor business formation presents many benefits, including enhanced possession defense and tax obligation optimization possibilities. The robust personal privacy and privacy measures available add to economic safety, while the flexibility in possession structures advertises efficient company control. Access to worldwide markets promotes varied financial investment possibilities, further strengthening the allure of offshore entities. These strategic benefits emphasize the importance of thinking about overseas firm formation as a practical choice for individuals seeking to secure properties and maximize tax obligations.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Alicia Silverstone Then & Now!

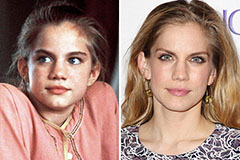

Alicia Silverstone Then & Now! Anna Chlumsky Then & Now!

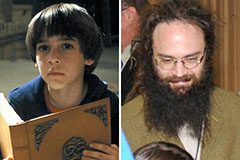

Anna Chlumsky Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now!